How To Turn $50 A Week Into $500K

Earlier this afternoon I sat down for the first time with a client who was just beginning her investment journey. She, like many that I've sat down with before, came in full of questions and eager to learn more about investing and our strategy to ensure that she can reach all her goals and enjoy a comfortable life.

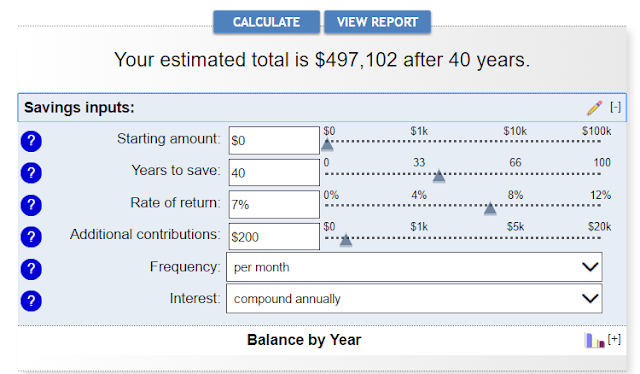

After listening intently to all the goals and plans that she had for herself I asked this simple question, "Are you able to commit $50 a week to aid you in reaching these goals?". She of course responded with a quick "Yes", going on to say $50 a week would be no problem at all. The reason I asked for $50 a week is because that $50 is what we will use to build you a half million-dollar retirement account. Yes, that's all it takes is $50 a week placed into an account earning an average return of 7% a year. In other words, $200 a month for 40 years at a rate of 7% would leave you with just a touch under $500K. I'll illustrate this below:

As you can see, the beginning balance is zero, being that she was 25 years old we set the years to save at 40, we assumed a 7% annual rate of return on her investments and last we set the monthly contributions at $200.

I also asked her to make me one more promise, to promise me that when she gets that annual raise or a bonus check that we'll sit down again just like this and increase these monthly contributions so that as she climbs her way up the corporate ladder her investment accounts climb with her. For example, let's assume that in 15 years she is now making considerably more money than she was when we began her investment journey. She is now making right around $100K per year and we'll assume that after a 20% tax rate her take home pay is about $80K per year or a little more than $3K a month. That being the case, I would then say to her let's kick this retirement savings into overdrive and start contributing $100 per week now. All other things equal, for the last 20 years leading into her retirement she'll continue to contribute the $100 a week. Bumping that up for those last 20 years now gives her an additional $100K bringing her to a retirement account of about $600K. Couple that money with her employer sponsored plan, add in any other money she may have in the bank and suddenly she's put together a pretty nice retirement number.

I tell this story because these results are far from unrealistic and can be duplicated by anyone. If you have the discipline to set money aside each month and pay yourself first you will be rewarded handsomely later in life. So please use her story as a blueprint to write your own story because there are very few things about the future that we can control but this we can control and the smart investors are doing just that.

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance is no guarantee of future results. Please note that individual situations can vary.

This is a hypothetical example and is not representative of any specific situation or investment product. Your results will vary. The hypothetical rates of return used do not reflect the deduction of fees and charges inherent to investing