Remember 2008? Use This Strategy To Help Protect Your Money

Our financial markets have made a gargantuan move higher since the presidential election results back in November. If you have an IRA, 401K or other investment account you've more than likely heeded some substantial gains over the past 7 months. President Trump, like him or not, has made some bold claims for boosting our economy and up until now that has all seemed to have gone quite well. Unfortunately, as we've seen of late, he's having a difficult time adjusting to this new position thus making the markets increasingly weary of the future.

Where do investors turn for help with their investments in times like this? My team went to the drawing board and asked a handful of our clients what type of option they would need to feel confident and put them in a position to succeed given the current state of the market.

Here's what we were told:

- They wanted the ability to participate in a market rally if it continued to rise from here

- They wanted a downside buffer to protect them against some losses if the market slips

- And lastly, they wanted it to be a low cost, affordable option

Basically, they wanted all the good of the market while having some protection against the bad.

We worked with our partners and established a new investment strategy that provided our clients with the solutions they desired.

This new solution allows our investors to:

- Participate in a rally if the market continues higher.

- Have the ability to chose what level of protection or how much of a buffer they would like against a downturn in the market.

- As for cost, how much does this solution set them back? This solution has NO fees.

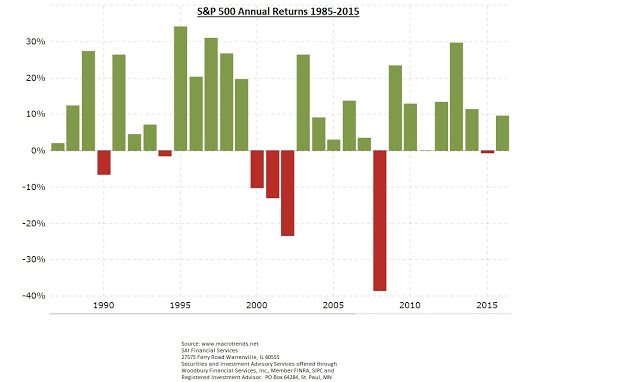

Over the past 30 years, the S&P 500 has seen a total of 7 negative return years. We wanted to find a solution to help with the downside of the market.

Upon seeing seeing the reaction from our clients, I knew this was the right solution for many of our clients both large and small. If you would like to take advantage of this opportunity please feel free to reach out to me so we can determine how to incorporate this into your current investment strategy.

*The views expressed are not necessarily the opinion of Woodbury Financial Services, Inc., and should not be construed directly or indirectly, as n offer to buy or sell any securities mentioned herein. Individual circumstances vary. Investing is subject to risks including loss of principal invested. No strategy can assure a profit against loss. Indexes cannot be invested in directly, are unmanaged and do not incur management fees, costs and expenses.